Eligibility Optimization

PERCEPTION

- Eligibility data is accurate.

- There is no need to reconcile data sent to the vendors and carriers.

- Any discrepancies are not material.

- Eligibility Optimization is a dependent eligibility audit.

REALITY

- Common nomenclature, large investments in internal HRIS or outsourcing eligibility function leads employers to assume the data is accurate.

- 1% to 2% of total health care spend is erroneously paid by vendors for ineligible claims. For groups with high turnover this number trends 4%-6%.

- Depending on your benefits spend, 1% to 6% can equate to millions of dollars in annual savings.

- Eligibility Optimization is NOT a dependent eligibility audit. It is a complete reconciliation of all claims paid against member eligibility.

WHY ELIGIBILITY OPTIMIZATION

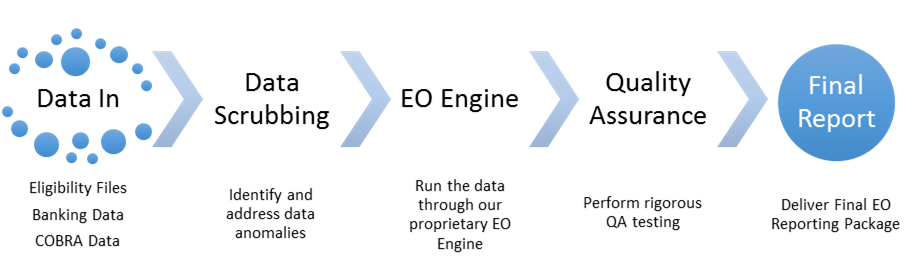

- Minimal internal resources required with a streamlined data gathering process.

- Quick turnaround time once data is collected.

- Provides a detailed reporting package which identifies ineligible payments and a road map for process improvement to mitigate the underlying issues.

If your eligibility segment accounts for 1% to 6%

how much are the other segments?

CASE STUDIES

Savings Rate

Savings Rate Employees

Employees Members

Members Checks

Checks Health Care Spend

Health Care Spend

MEDIA

- 2.10%

- 20,000

- 38,000

- 215,000

- $120M

MANUFACTURING

- 1.37%

- 4,000

- 9,000

- 110,000

- $33M

PHARMACEUTICALS

- 1.20%

- 900

- 2,300

- 31,000

- $7M

Frequently Asked Questions

The Eligibility Optimization Assessment includes a complete reconciliation of healthcare claims against eligibility during the chosen time period. The result is a comprehensive reporting package which details the ineligible claims by reason of ineligibility, grouped by both family unit and individual: everything you need to show to your health plan vendor. As part of the reporting package, you will receive a roadmap to solve the underlying inefficiencies and ensure your claims and eligibility are correctly processed in the future.

Ineligible claims happen for several reasons, usually around a time of employee or dependant transition; below are just a few examples:

- Aged Out Dependants: under typical plan design, dependants qualify to receive coverage under their parents’ plans through age 26. When the dependant turns 27, however, they are no longer eligible. Unfortunately the fact that the dependant has aged out, often takes several weeks to process. If the dependant submits a claim after their 27th birthday and the claim is paid by your insurance carrier, the Eligibility Optimization tool would flag the claim as ineligible.

- Claims Paid After Coverage: if an employee walks off the job without submitting a formal resignation letter, or without informing their supervisor, it can take a while to recognize and process the termination. If the employee and/or their dependants submit claims during that time, the Eligibility Optimization tool would flag the claims as ineligible.

The Eligibility Optimization reporting tool would provide a report to enable you to re-adjudicate the claims in these scenarios because traditionally when a retroactive eligibility is submitted there is no automated re-adjudication process.

The ineligible claims have been processed and paid by your insurance carrier. The underlying issues however, may span your internal systems and processes, your benefits administrator as well as your insurance carrier. Once we identify the ineligible claims, we will provide you with a reporting package including a roadmap of how to align all of the stakeholders to address the issues and ensure that both claims and eligibility are processed correctly in the future.

You can! In fact, we would be happy to walk you through the process and the tools you need to perform the reconciliation internally. Contact us to schedule a quick conversation about Eligibility Optimization.